UK aesthetic clinics are increasingly facing scrutiny from tax authorities over Value Added Tax (VAT) on cosmetic procedures. A 2010 change in VAT rules stated that elective aesthetic treatments without medical justification must charge VAT. However it never clarified subtle differences between medical vs aesthetic, nor it provided a clear path on how to charge for either. Which brings us to today, with HMRC (Her Majesty’s Revenue & Customs) stepping up enforcement. Aesthetics Today has carried out an in-depth investigation to find out how serious the situation is and how far-reaching the consequences are for the UK aesthetics sector.

2010 VAT Rules on Medical vs. Cosmetic Treatments

In the UK, healthcare services are generally exempt from VAT under existing regulations. But ONLY if they qualify as “medical care” under the law. In 2010, authorities made it clear that aesthetic services provided without a medical purpose would fall outside this exemption and thus be subject to the standard VAT rate (20%). The UK VAT Act 1994 (Schedule 9, Group 7) exempts “the provision of medical care” by registered health professionals, where medical care means diagnosing, treating or curing a disease or health disorder.

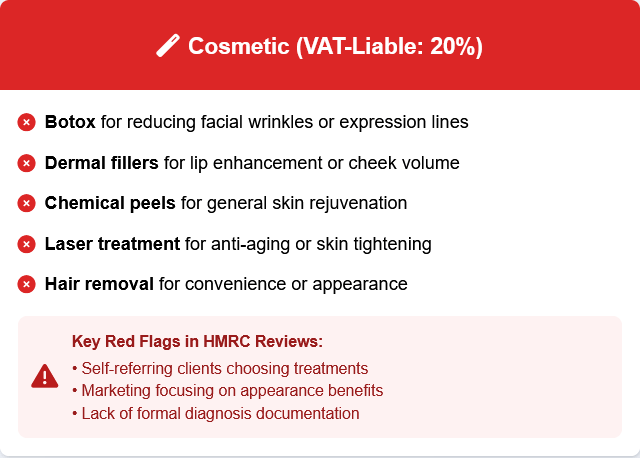

Treatments purely for cosmetic enhancement do not meet this definition. HMRC’s guidance confirms that it will usually treat cosmetic services as VAT-exempt only if they are undertaken as part of a health care treatment program. Otherwise, purely aesthetic services are standard-rated. In practice, there is a two-part test for VAT exemption on procedures:

- (1) the provider must be a qualified practitioner on a statutory medical register acting in that professional capacity, and

- (2) the primary purpose of the service must be “the protection, maintenance or restoration of the health” of the patient.

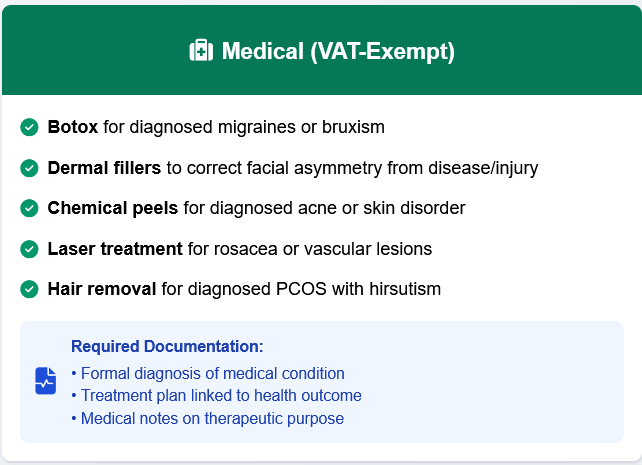

Under these rules, a treatment like a dermal filler or Botox injection can be VAT-free. But only if it is done to treat a diagnosed medical condition or dysfunction (for example, using Botox to alleviate chronic migraines or treat bruxism). If the primary reason is simply to improve someone’s appearance (reduce normal wrinkles, enhance lips, etc.), then it is not exempt and VAT must be charged. HMRC generally deems popular aesthetic procedures such as anti-wrinkle injections, dermal fillers, chemical peels, laser hair removal and the like, as taxable unless there is clear evidence they are part of treating a medical issue.

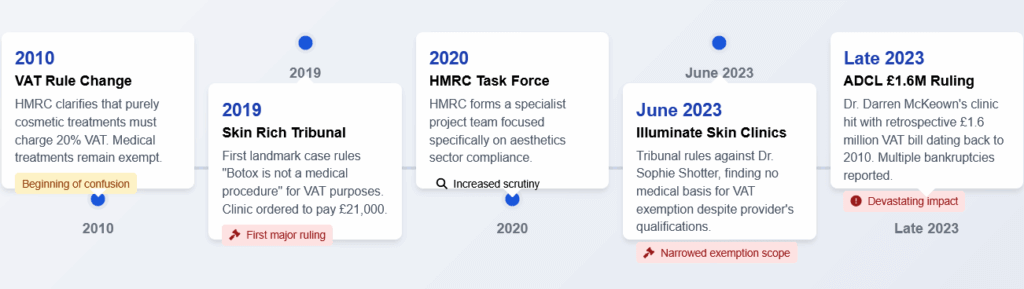

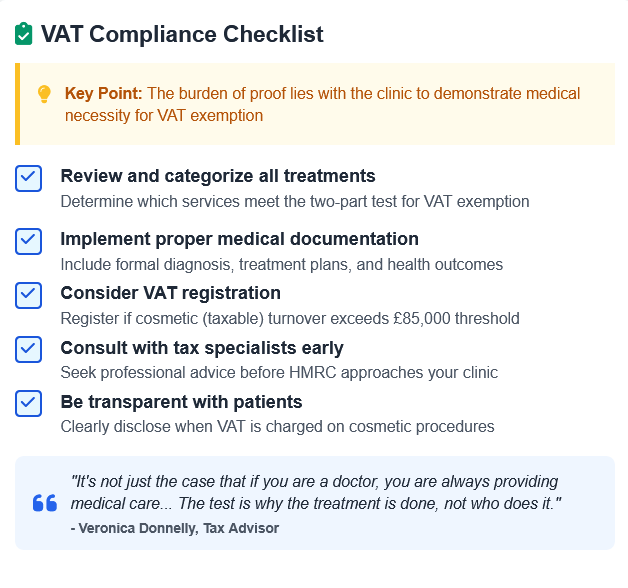

Timeline of Key VAT Enforcement Events

This distinction was emphasised around 2010, aligning UK policy with EU VAT directives, and it set the stage for the compliance challenges clinics face today. Notably, the VAT registration threshold (currently around £85,000 in taxable turnover) applies only to cosmetic (taxable) revenue, not genuine medical treatments. But HMRC will look at total clinic turnover initially. If it exceeds £85k, the onus is on the clinic to prove that the taxable (cosmetic) portion is below the limit. Many practitioners wrongly assumed that being a doctor or using prescription medicines automatically made all their procedures VAT-free, but that is not the case.

HMRC’s post-2010 stance was met with some concern in the medical aesthetics community. Back in 2011, the British Association of Aesthetic Plastic Surgeons (BAAPS) agreed that non-surgical cosmetic treatments (which make up the vast majority of procedures) should bear VAT, but warned against a blanket tax on cosmetic surgeries. They noted HMRC’s rule, that services are only exempt if meant to “protect, maintain or restore” health, was “subjective” and placed a value judgment on treatments.

BAAPS called this approach an “ethical minefield,” arguing it fails to recognise the psychological and quality-of-life aspects that many plastic surgery patients experience. In other words, ever since the law began taxing purely aesthetic services, there has been debate over how to draw the line between legitimate health-related treatments and those done “purely for beautification”.

HMRC Crackdown in the Aesthetics Sector

In the past few years, HMRC has actively targeted aesthetic clinics to enforce these VAT rules. A specialist HMRC project team was formed to look at the aesthetics sector, leading to a number of high-profile investigations and tax tribunal cases. So far, every case has been decided in HMRC’s favor. Tax experts had been warning clinics for years that a crackdown was coming, but a 2019 tribunal case brought the issue into the spotlight and sent shockwaves through the industry.

One early example was the Skin Rich clinic in Richmond, London. In June 2019, Skin Rich faced a First-Tier VAT Tribunal over whether its botulinum toxin (Botox) and other injectable treatments qualified as medical care. The verdict was headline-grabbing: “Botox is not a medical procedure so VAT will have to be added.” The tribunal found that in Skin Rich’s case, the treatments’ primary purpose was not to protect or restore health, and thus they did not meet the medical exemption. HMRC argued, and the court agreed, that clients sought these treatments “principally for cosmetic reasons,” not because of an underlying health disorder. Skin Rich was ordered to pay approximately £21,000 in VAT that it had not charged on those services. But that is the tip of the iceberg.

This case underscored that even a qualified doctor providing treatments in a clinic setting could not assume VAT exemption without clear medical justification. As tax advisor Veronica Donnelly noted, the legal test didn’t actually change in 2019. It remained the same two-part test. The Skin Rich ruling highlighted that HMRC would demand evidence of the treatment purpose, and that lack of documentation or diagnosis would be fatal to an exemption claim. She cautioned that such VAT assessments “have the potential to put people out of business,” and indeed the case caused panic among aesthetic practitioners at the time.

Since then, HMRC’s enforcement has continued. In 2023, another prominent case involved Illuminate Skin Clinics Ltd, run by Dr. Sophie Shotter. In that tribunal (decided June 2023), the clinic, operated by a GMC-registered doctor, argued that its suite of services (Botox, fillers, fat-freezing, prescription skincare, etc.) were provided as medical treatments and should be exempt. However, the tribunal found that although Dr. Shotter’s qualifications met the first test, the services failed the primary purpose test. The evidence showed “no diagnosis of a health disorder or disease, no referral from a doctor… no healthcare or treatment plan” supporting a medical purpose.

Essentially, patients were self-referring and choosing cosmetic treatments, which the tribunal said is not the same as a doctor treating a diagnosed condition. The judge noted that helping someone achieve personal appearance goals, even if they feel better about themselves, is “not treating someone’s mental health status” or disease. He continued to claim that “it is a misuse of language to say that this is healthcare” in the sense required for VAT exemption. As a result, Illuminate’s services were judged standard-rated (taxable). Tax specialists have flagged that this decision potentially narrows the scope of the exemption and could have significant implications for others in the industry. HMRC is known to be actively inspecting clinics, and the Illuminate case gives it even more confidence that most cosmetic skin treatments should be taxed.

Perhaps the most dramatic example is the case of Aesthetic-Doctor.com Ltd (ADCL), a private clinic owned by Dr. Darren McKeown. ADCL had been trading since 2008, providing cosmetic services like Botox, dermal fillers, hair transplants and laser treatments to improve appearance. The clinic did not register for VAT, apparently believing its services were medical. After a lengthy enquiry, HMRC issued a notice in 2020 requiring ADCL to register retroactively from 1 June 2010, on the basis that by that point the clinic’s cosmetic treatment turnover had exceeded the VAT threshold. HMRC then raised a £1.6 million assessment for unpaid VAT on ADCL’s sales dating all the way back to 2010. Dr. McKeown appealed, but in late 2023 the First-Tier Tribunal also ruled against his clinic.

Echoing the earlier cases, the tribunal found ADCL was not providing exempt “medical care” in the VAT sense. It noted that while psychological issues can in theory count as “health disorders,” ADCL failed to prove any specific patient’s issues or diagnoses. “Patients chose [the] services because they wished to improve their appearance”, not because of a defined medical need. Feeling unhappy about looking older, for example, was not considered a medical condition: “Individuals worrying that they were looking older were not suffering from a health disorder. Ageing is not generally viewed as a disease,” the tribunal observed bluntly. In the absence of evidence of diagnosed conditions, the £1.6M backdated VAT bill stood. A massive financial blow for the clinic.

Aesthetics Today has exclusive information about at least two more cases which have led to bankruptcy. The risks for clinics that interpreted the rules incorrectly were always high. HMRC’s dedicated aesthetics compliance team has more cases in the pipeline, according to industry insiders. Dr. John Curran, a founder of the British College of Aesthetic Medicine (BCAM), noted in late 2019 that he was aware of “six clinics or individuals currently” dealing with HMRC approaches on this issue. HMRC is willing to look back many years and recover unpaid VAT from aesthetic providers who cannot substantiate a medical exemption for their cosmetic treatments.

Retroactive Tax Bills, Penalties & ‘Medical Necessity’ Ambiguity

One of the most contentious aspects of this VAT crackdown is the retroactive application and steep penalties. If a clinic was supposed to be charging VAT but wasn’t, HMRC has the power to demand all the backdated VAT for past periods, potentially going back to the very start of the business if it never registered for VAT. In contrast, businesses that are VAT-registered are usually only assessed up to 4 years back for errors, but non-registration cases can reach much further. This means a clinic that has operated for years treating everything as VAT-exempt might suddenly be hit with a decade’s worth of VAT liabilities, as happened with Dr. McKeown’s £1.6M assessment.

On top of that, HMRC can levy substantial penalties. By law, a penalty of up to 100% of the unpaid VAT can be charged for a “deliberate” failure to account for VAT (even lesser mistakes can incur 30%+ penalties). In effect, HMRC could double the bill, owing £100,000 in back VAT might also mean a £100,000 fine on top. As one accountant in the field put it, “VAT inspections are exorbitant, both in terms of cost and time lost, but also the anxiety it causes the clinic owner”, even if ultimately no wrongdoing is found. The mere prospect of a surprise six- or seven-figure tax bill is enough to cause sleepless nights for aesthetic clinic owners. Some fear that these retroactive charges could force clinics into closure or bankruptcy. It’s no wonder that when the issue hit national headlines, there was “panic across the industry” about the impact.

Another challenge is the inherent ambiguity in defining “medical necessity” for borderline cosmetic treatments. The VAT law’s criteria, “primary purpose of protecting, maintaining or restoring health”, can be subjective when applied to aesthetic procedures that may have psychological or emotional benefits. HMRC’s stance has been relatively strict: wanting to improve one’s appearance or self-confidence, by itself, does not qualify as a health purpose in the tax sense. For example, a patient might feel psychological distress about wrinkles or a minor cosmetic flaw, but unless a practitioner can point to a recognised medical condition (physical or mental) that is being treated, HMRC considers the treatment “purely cosmetic”.

The tribunal in that case explicitly addressed this, rejecting the argument that improving a patient’s self-esteem amounted to treating a mental health disorder. “Helping someone to achieve goals in relation to their appearance… is not treating someone’s mental health status,” the judge wrote, calling it “a misuse of language to say that this is healthcare” for VAT purposes. In other words, the bar for medical exemption is high. There should be a diagnosed condition or clinically recognised need at stake, and the treatment should be a response to that diagnosis. If a patient simply wants a treatment and a clinician provides it without any documented health rationale, it will be hard to argue it was “medical.”

Clinicians and industry groups have pointed out that the line can be blurry. Many aesthetic doctors argue that they do consider patients’ mental well-being and self-esteem as part of overall health. In fact, the European Court of Justice has taken a broader view in the past, interpreting “medical” to include psychological and psychosocial reasons, and noting that it is the clinician’s judgment that matters in deciding if a procedure has a therapeutic aim or is purely cosmetic. This ECJ guidance suggests that if a doctor believes a cosmetic treatment is necessary to a patient’s mental or social well-being, it could be considered medical. However, in practice HMRC and UK courts require solid evidence to back this up.

The clinician’s opinion needs to be supported by good documentation, consultation notes, a diagnosis (which might even be a psychological assessment), and a clear treatment plan or rationale linking the procedure to health outcomes. Without that, the default assumption is that the procedure was elective and cosmetic. BAAPS has criticised HMRC’s narrow focus, saying it “fails to recognise the extensive scope and purpose” of many plastic surgery procedures, including psychological and social welfare aspects. They worry that forcing a determination of “medical need” on a case-by-case basis intrudes on doctor-patient confidentiality and could lead to inconsistent, even arbitrary, decisions by tax authorities. For instance, two patients getting the exact same procedure might be treated differently for tax if one had a doctor’s note about psychological harm and the other did not.

Clinics have to exercise caution and diligence. Essentially, the burden of proof lies with the provider to demonstrate why a treatment was medically necessary. If there is any doubt, HMRC will likely err on the side of “it’s cosmetic (taxable)” and leave it to the clinic to prove otherwise. This places importance on detailed patient assessments. As Dr. Curran advises, “each patient/treatment should be assessed on a case-by-case basis” regarding whether it is exempt or not. The starting point of genuine medical care is a diagnosis. If a clinic’s records don’t show a diagnosed condition or health-driven treatment plan, a claim of medical exemption may fall apart under scrutiny.

To navigate the grey areas, many clinics are now bolstering their consultation practices: documenting patients’ symptoms, psychological state, and the therapeutic goals of any treatment. The aim is to have contemporaneous evidence that, say, a course of laser therapy was to treat severe acne scarring that was impacting the patient’s mental health (and not just to look a bit younger or smoother for vanity reasons). Good record-keeping has become absolutely critical. Several experts have noted that in any VAT dispute, the case will stand or fall on the strength of the clinic’s documentation of medical need.

Industry Perspectives

Within the UK aesthetics industry, the VAT issue has prompted both alarm and proactive guidance. Professional associations, clinic owners, and advisors have been urging colleagues to get educated on the rules and to tighten up compliance. Dr. John Curran of BCAM, who has worked for over a decade to clarify VAT questions for aesthetic practitioners, emphasises that being a doctor or nurse is not a free pass. Why you are doing a treatment is what matters, not just who is doing it. He advises that even VAT-registered clinics must carefully categorise each treatment. “Even if the practitioner’s business is registered for VAT, each patient/treatment should be assessed on a case-by-case basis (as being exempt or non-exempt using the ‘purely cosmetic’ criteria)” Dr. Curran says. In his view, many common procedures can have a legitimate health element. For example, treating excessive facial hair in a woman with polycystic ovary syndrome is very different from removing some body hair for convenience.

Likewise, using dermal fillers to correct a disfigurement or using Botox to relieve a patient’s debilitating jaw tension would be health-driven. He recounts that in discussions with HMRC, the agency did concede that a “wide range” of cosmetic dermatology treatments might have a medical purpose. But HMRC insists on seeing evidence in the form of “good medical records… setting out a medical purpose” for the treatment. Dr. Curran has even argued from an ethical standpoint: “It is my strongly held opinion, having read Good Medical Practice, that it is unethical for a doctor to treat a patient purely for cosmetic reasons without giving regard to protecting the health of the patient.” In other words, a doctor should always have some health rationale in mind. If there truly is “no medical reason” for a procedure, Curran suggests the practitioner should “be honest about it” and charge the VAT rather than trying to fit it under an exemption. This perspective encourages a culture of transparency, where you either find the medical merit in what you’re doing (and document it), or accept that it’s cosmetic and comply with the tax.

Tax experts and consultants working with aesthetic businesses echo this call for diligence. Samantha Senior, known as “The Aesthetics Accountant,” has noted with concern the persistent myths in the industry about VAT. She stresses that clinics need to get their accounting and categorisation in order from day one, separating income from VAT-exempt treatments and cosmetic treatments clearly. Her firm encourages practitioners to not bury their heads in the sand. As she fact-checked a blog on this topic, Senior commented: “VAT inspections are exorbitant… and it’s still very frustrating to see a significant amount of misinformation circulating within the industry”. She finds it “reassuring” that platforms are now spreading correct information. The overall advice from accountants is to approach this pro-actively. If you’re nearing the VAT threshold (or already over it), consult a tax advisor, review all your treatment offerings and ensure you have justification on file for any treatment you consider health-related and VAT-free.

Veronica Donnelly, the tax advisor involved in the Skin Rich case, warns against any attempt to game the system. Practitioners should not view the medical exemption as a loophole to exploit by simply labeling everything “medical.” “It’s not just the case that if you are a doctor, you are always providing medical care… in tax case law being on a medical register does not stop you from doing something that is not for a medical purpose,” she explains. The test is why the treatment is done, not who does it.

Donnelly cautions that if a clinic claims 100% of its treatments are medical, both she and HMRC would view that with skepticism. Instead, the focus should be on “seriously considering the purpose” of each procedure and then writing it down in the records. In a stern reminder, she says, “Where you can clearly evidence a medical purpose then VAT is exempt. If not, it’s cosmetic.” There are no shortcuts in her view. Solid evidence is the only shield against a challenge. Advisors think that the sector needs to stop any wishful thinking that the issue will go away, and instead ensure compliance and documentation are up to scratch.

Industry associations have also been advocating on behalf of practitioners. BAAPS, as mentioned, raised ethical and practical concerns about how the rules are applied. Particularly for surgical practices that often cross the line between functional health improvement and cosmetic enhancement. They feared “postcode lotteries” in VAT decisions and pressured the government to clarify the criteria early on. More recently, organisations like the British College of Aesthetic Medicine have been providing guidance to their members on how to remain compliant. The overarching theme from the industry perspective is one of adaptation.

How Other Countries Tax Aesthetics

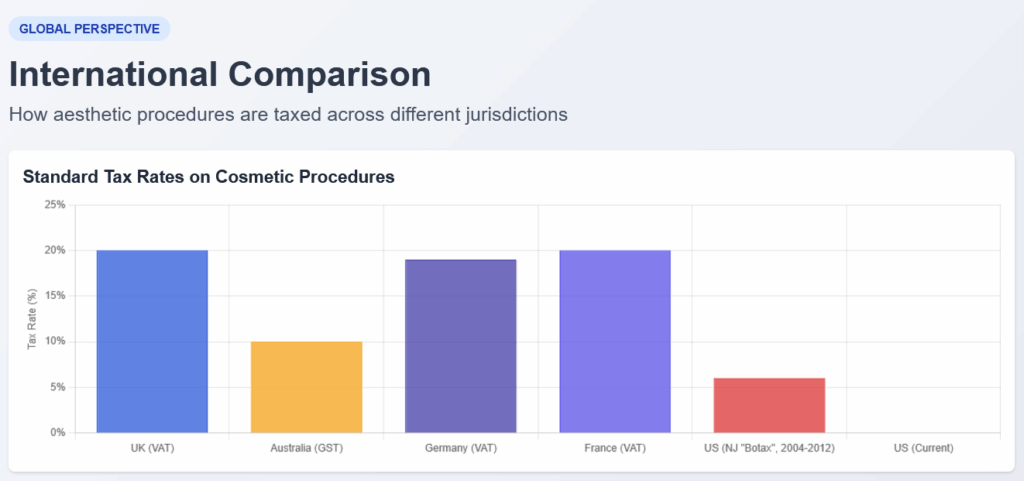

The VAT treatment of cosmetic procedures is not unique to the UK. Different countries have taken varied approaches to taxing (or not taxing) elective aesthetic services:

- United States: The U.S. has no VAT. Healthcare services are typically exempt from state and local sales taxes, and purely cosmetic procedures generally aren’t specifically taxed either. There have been isolated efforts to tax cosmetics, most famously New Jersey’s “Botax.” In 2004 New Jersey instituted a 6% tax on gross receipts from cosmetic surgeries and treatments (covering everything from surgical cosmetic operations to Botox, fillers, laser hair removal, and even cosmetic dentistry). The revenue was used for public healthcare funds. However, this proved unpopular and was phased out after several years. The tax was reduced to 4% in 2012, then 2%, and finally fully repealed by July 2013. After that repeal, no U.S. state currently imposes a broad-based “cosmetic procedure tax.” Cosmetic treatments in the U.S. remain subject only to the provider’s fees (and any standard business taxes), but patients cannot deduct purely cosmetic medical expenses on their income tax. The short-lived New Jersey experiment is evidence that such taxes are hard to sustain politically.

- Australia: Australia’s GST (Goods and Services Tax) system parallels the UK/EU approach in distinguishing medical vs. cosmetic. Under Australian tax law, most medical services are GST-free (no 10% GST charged) if they are billed to Medicare or generally accepted as necessary health services. Conversely, purely cosmetic procedures are taxable. The Australian Taxation Office explicitly states that procedures which “alter or enhance a patient’s appearance but have no medical or reconstructive purpose” are considered cosmetic and therefore taxable (subject to GST). In practice, if a procedure is eligible for a Medicare rebate (indicating it has a medical necessity, e.g. reconstructive surgery, therapeutic treatments), it will be GST-free. If not, the 10% GST applies. So a nose reconstruction after an injury would be exempt, but a routine cosmetic rhinoplasty for appearance would include GST in Australia. Australian clinics must similarly document the medical justification to treat a service as GST-free.

- European Union: EU member states all operate VAT systems, guided by the EU VAT Directive, which provides an exemption for medical care services. This directive (2006/112/EC, Article 132) is the basis of the UK’s old rules. Across the EU, the pattern is the same. Therapeutic health services (by licensed professionals) are VAT-exempt, while cosmetic treatments with no therapeutic aim are taxable at the standard VAT rate (which varies by country, typically 20–25% in many countries). In countries like Germany and France, a cosmetic surgery or treatment is only exempt from VAT if it is deemed medically necessary by a doctor’s certification. Otherwise, 19% VAT (Germany) or 20% VAT (France) applies to the service fee. There can be some differences at the margins. For example, until recently Estonia had a particularly lenient approach, exempting virtually all aesthetic medical services from VAT as “healthcare.” This is now changing under pressure to align with EU rules. Estonia’s authorities have stated that their law was “more lenient than the European directive” and are moving to distinguish medical vs. aesthetic cases for VAT purposes. Overall, within the EU the trend is toward the same interpretation the UK uses, though enforcement intensity can vary. Clinics in EU nations also face the challenge of proving a procedure’s medical rationale to avoid charging VAT.

A Strange Place to Be

The enforcement of VAT on non-medical aesthetic services in the UK has become a pressing issue for the industry. A rule that has technically been on the books since 2010 (and rooted in long-standing EU law) is now being enforced with new vigor by HMRC. Clinics that once assumed their cosmetic treatments were “healthcare” and outside VAT have received a rude awakening in the form of investigations, tribunals, and hefty backdated tax bills. Insider information obtained by Aesthetics Today reveals that the problem could be affecting a shocking 30% of all aesthetic clinics. Some either adapted VAT late or not at all, amidst an avalanche of misinformation about the law since 2010.

The key lessons for practitioners are clear. First, know the law. Second, document everything. Third, don’t wait. Experts urge clinics to get compliant before HMRC comes knocking. It is simple math really.

However the situation might be more dire than it appears. If enforcement continues, more and more clinics will have to pay up or shut their doors in face of large backdated HMRC bills. The upheaval can have serious consequences for existing players. In some cases leaving more business for others, in other cases allowing new companies to enter the market. One thing is certain. Only few clinics which avoided the rules will survive.

In the meantime, clinic owners and industry bodies continue to seek greater clarity (for example, clearer definitions of psychological indications for treatment) to ensure that necessary treatments remain accessible without tax, while purely vanity procedures carry the tax as intended.

The UK is not alone in this approach. The balance between taxing luxury cosmetic services and exempting true healthcare is a common policy challenge. For UK practitioners, the path forward is to embrace a transparent, case-by-case approach to avoid the costly bite of an HMRC enforcement action.