Skincare companies have spent a considerable amount of effort and money fighting medical aesthetics. To no avail. But are the tables now finally turning? L’Oréal has already made a move. Is Estée Lauder Companies (ELC), the global prestige beauty powerhouse behind brands like La Mer, MAC, and Clinique, also setting the stage for a cheeky change? This is the one move that would push it far beyond cosmetics and into the medical aesthetics sector. There has been no formal announcement about this yet, but there is more and more evidence suggesting that ELC could be preparing for a deeper entry into the clinical aesthetics space.

On March 20, 2025, posts from Chinese beauty news outlet CHAILEEDO revealed a potentially game-changing partnership. ELC has teamed up with Shanghai Jiahui Health to launch the Estée Lauder Companies, Jiahui Health Joint Clinical Research Center. According to the release, the centre’s mission is to explore full-cycle skin changes and post-procedure care through rigorous clinical research. This move would position the company much closer to medical aesthetics than ever before.

For those unfamiliar, the U.S. Food and Drug Administration (FDA) is the regulatory body overseeing product safety in the United States. They have recently approved several innovations showing how dynamic and fast-paced the medical aesthetics space has become. This includes new categories like injectable skin boosters (like Skinvive by Juvéderm) and advanced HA fillers like the recently approved Evolysse range by Evolus. As the market grows, there is additional competitive intensity in medical aesthetics. A situation that Estée Lauder may be eyeing not from the sidelines, but as an emerging competitor.

From Skin to Science: Strategic Speculation

While ELC has historically steered clear of medical devices or prescription-based aesthetics, its recent acquisition of Deciem (parent of The Ordinary) and its New Incubation Ventures (NIV) arm point to a company willing to experiment across the beauty–science spectrum. The recent Jiahui partnership builds on this trend, offering Estée Lauder access to clinical data, dermatology expertise and consumer behaviour insights. All these are specific to the rapidly expanding post-procedure skincare market in China. This is a segment projected to grow at 30% CAGR through 2026, reaching ¥25.38 billion (~$3.5 billion USD).

In that context, this new collaboration might not just be about product development. It could be an entry point into the more advanced territory of clinical-grade skincare. Post-laser and energy-device topicals, and potentially even home-use devices co-developed with medical professionals could be considered.

It’s worth remembering that Estée Lauder already dipped a toe into this realm in 2024 when Clinique partnered with Jiahui Health to address hyperpigmentation caused by energy-based treatments. This is a key concern among patients undergoing laser, IPL, or RF-based therapies. With the new research centre expanding this scope, we speculate that ELC could now be setting its sights on developing regenerative, preventative, or recovery-focused formulations for use after procedures like microneedling, injectables, or even threads.

Why would Estée Lauder make this move now? Several factors create a compelling case here.

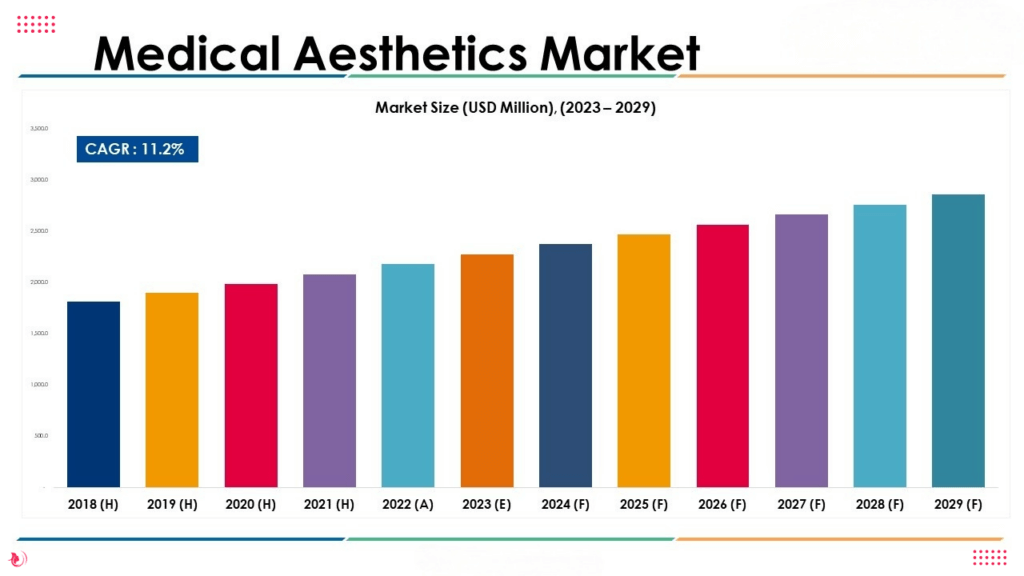

- Medical aesthetics is booming. Valued at over $82 billion in 2023, the sector is expected to grow rapidly, with non-invasive procedures like Botox and fillers dominating the field. Beauty brands are eager to enter this higher-margin, results-driven space.

- Consumer behaviour is shifting. Younger generations are blending beauty with biohacking and preventative aesthetics. Think “prejuvenation,” skin boosters, and post-treatment repair. There are all categories that demand credibility and innovation.

- L’Oréal is already in play. With its 2024 stake in Galderma and scientific partnerships in injectables, L’Oréal is making aggressive moves. Estée Lauder can’t afford to lag behind if it hopes to remain competitive in the science-forward beauty future.

The China Strategy

It’s also impossible to ignore the China angle. China represents a critical growth market for Estée Lauder, particularly after its well-documented recent financial challenges. Jiahui Health is a leader in integrated healthcare with hospitals and clinics in Shanghai, Shenzhen, and Hong Kong. The partnership offers an established infrastructure for clinical trials, product validation, and direct-to-patient insights. All essential if ELC wants to bridge the gap between skincare and aesthetics.

Vice President of the China Innovation R&D Center, Guangwen He, confirmed the strategic value of this partnership, stating that Estée Lauder aims to bring “groundbreaking skincare solutions to consumers in China and worldwide.” The language, while carefully worded, strongly suggests a pipeline of new innovations grounded in clinical science and aesthetic integration.

In practical terms, this could manifest in several compelling ways. Estée Lauder may launch post-procedure skincare lines under brands like The Ordinary or Clinique, specifically formulated to address redness, inflammation, or pigmentation following treatments. The company could also explore home-use technologies, such as LED or microneedling devices, co-developed through clinical collaborations.

Topical alternatives to injectables, powered by peptides or polynucleotides, could emerge as part of a dermatology-led initiative, offering non-invasive anti-aging solutions. Additionally, we might see co-branded skincare developed for medical spas, blending professional treatments with retail experiences. Finally, clinical trials based in Asia could serve as a springboard for global product launches. That would allow Estée Lauder to establish early credibility in a space historically dominated by established pharmaceutical companies.

Estée Lauder has not confirmed any plans to directly compete with pharma-heavyweights like Allergan Aesthetics or Galderma. But the expanding network of clinical partnerships, dermatological R&D and consumer behaviour research suggest a long-game strategy that could eventually cross over prestige skincare and clinical aesthetics. If this is indeed the direction the brand is heading, it’s not just following a trend. It’s strategically positioning itself to shape the next era of beauty.

The ripple effects could redefine what it means to be a beauty brand in a world where science, skin health, and self-care are rapidly coming together.